Balance Sheet Management

- Home

- Leasing & Finance

- Balance Sheet Management

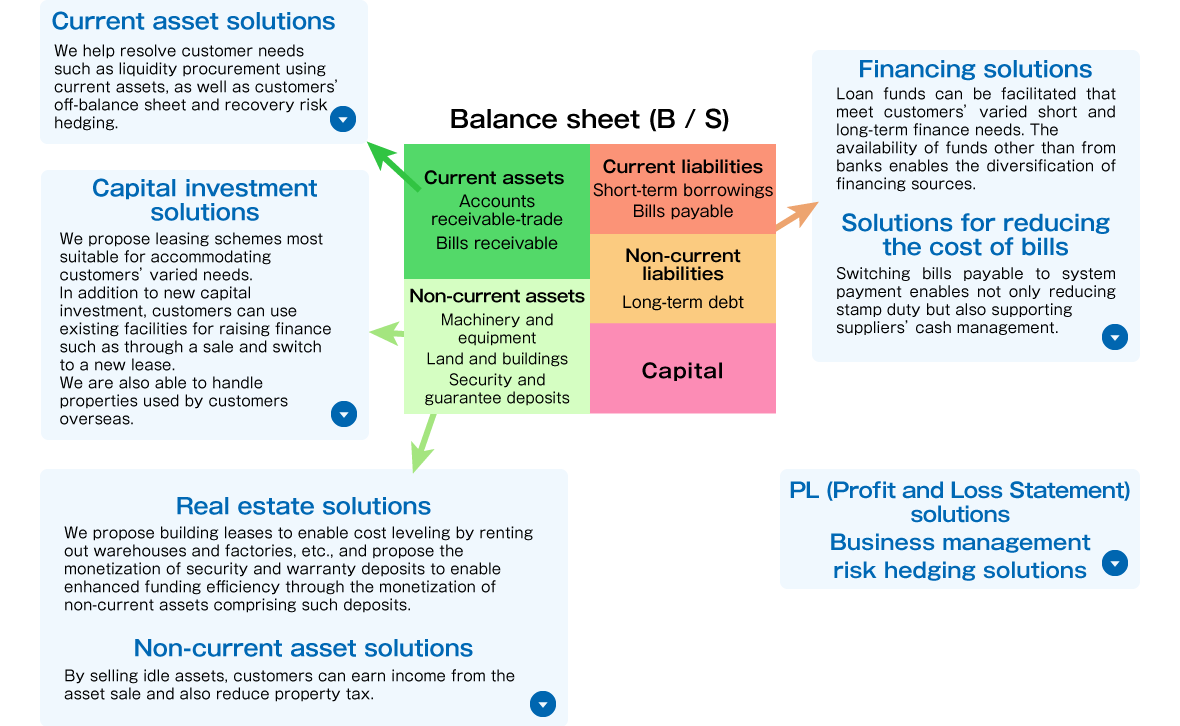

Balance sheet management

NTT TC Leasing provides off-balance sheet and hedging-focused financial products that can help customers with their balance sheet management.

In addition, we also offer sales promotion schemes that use leasing and installment purchases, as well as solutions such as tax deferral products.

Please use our financial solutions to help tackle a variety of financial strategy issues, including your ROA, D/E ratio, cash flow, and taxes.

Current assets

- Current asset solutions

-

We help resolve customer needs such as liquidity procurement using current assets, as well as the customer's off-balance sheet and recovery risk hedging.

Fixed assets

- Capital investment solutions

-

We propose leasing schemes that best suit customers' varying needs.

In addition to new capital investment, customers can sell existing capital and then switch to a new lease to raise finances.

We are also able to handle properties used by customers overseas. - Real estate solutions

-

Customers can smooth their costs by renting out properties such as warehouses and factories.

- Fixed asset solutions

-

Customers can reduce their property tax and earn income by selling their idle assets.

Current and fixed liabilities

- Fundraising solutions

-

We can provide loans that meet various fundraising needs. Customers can diversify how they fund their investments by having sources outside of banks.

- Reducing the cost of bills

-

By switching bills payable to system-based payments, not only are stamp duties reduced, but customers can also support their suppliers' fundraising efforts.

- Bulk factoring