Leasing & Finance

Japanese Operating Lease with Call Option (JOLCO)

Overview

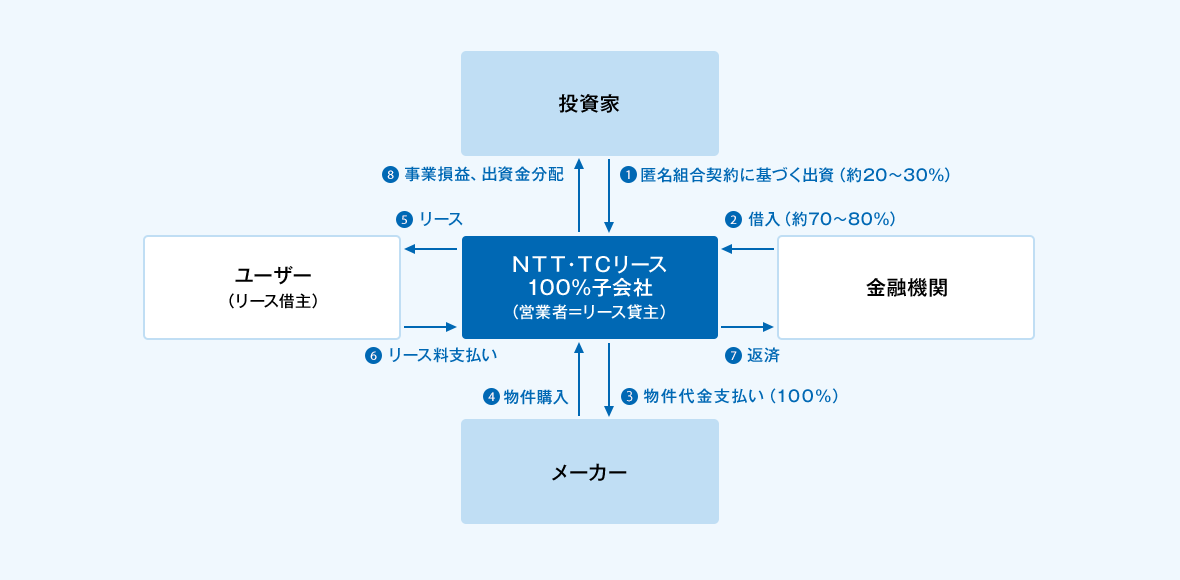

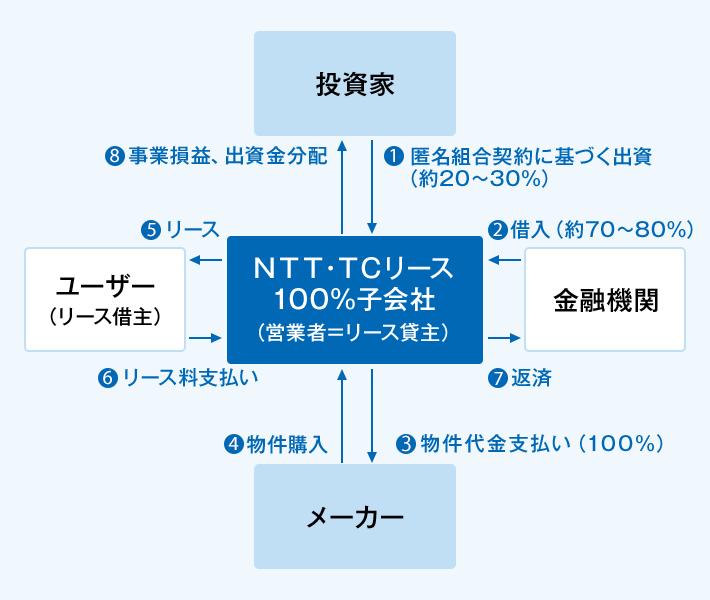

The Japanese Operating Lease with Call Option (JOLCO) was planned and structured by NTT TC Leasing for the leasing of large properties such as aircrafts. Through investments, customers can level out their periodic profits, and the leases are useful for long-term corporate and tax planning. In addition, it is possible for customers to make capital gains by selling their leased assets after the lease term ends.

Business model

- We hold leveraged leases for more than 100 aircrafts and have an impeccable JOLCO track record, with a large number of investors participating.

- There are various risks associated with JOLCO, including asset sales and currency exchange risks, so please contact a representative to learn more.

Risks

- There are no service fees that need to be paid by the investors directly to NTT TC Leasing, but a portion of the capital invested will be used to pay for the company's lease originator fees and other expenses related to the structure of our leasing business. Regarding the value of silent partnership transfers, the equivalent amount of interest accrued during the period until the date when an investment is actually made is included, and this amount will be returned to the transferor, NTT TC Leasing.

- Applicable investments are the silent partnership investments made to the JOLCO business operated by our wholly-owned subsidiary. Investments in this leasing business do not have a set yield rate, so the principal amount may be damaged and losses may exceed the principal amount if the transacting party such as the user (lease) defaults or if there are fluctuations in the secondhand market of the leased property.

For more information, please refer to the documentation (the pre-contract documents based on the Financial Instruments and Exchange Act) related to this leasing business.

Trade name: NTT TC Leasing Co., Ltd.

Director of the Kanto Local Finance Bureau (Financial Instruments) No. 3200

General Incorporated Association Type II Financial Instruments Firms Association Member (Type II Business Operator No. 631)

[Consultation about this service

Contact for complaints】

NPO Securities/Financial Instruments

Mediation consultation center (FINMAC)

〒103-0025

2-1-1 Kayabacho, Nihonbashi, Chuo-ku, Tokyo

- Reception phone number: 0120-64-5005

- Facsimile number: +81-3-3669-9833

- ホームページからの受付窓口 :

http://www.finmac.or.jp - Reception hours: Monday to Friday from 9:00 to 17:00 (However, holidays including transfer holidays, closed from December 31 to January 3)

- * FINMAC is an acronym for Financial Instruments Mediation Assistance Center.

- * A partial revision of the Financial Instruments and Exchange Act (hereinafter referred to as the “Law”) (Law No. 58 of 2009) created the financial ADR *1 system, which allowed financial instruments business operators to For each type of registered business, the obligation to take complaints handling measures and dispute resolution measures (Article 37-7, Paragraph 1, Item 1 of the Law) was imposed.

JOLCO (Japanese Operating Lease with Call Option)

Inquiries about

Department: International Business Department Aircraft and Ship Finance Division

Reception hours: 9:00 to 17:00

Monday to Friday (excluding holidays and year-end and New Year holidays)