Leasing & Finance

Leasing & Finance

Operating lease

Overview

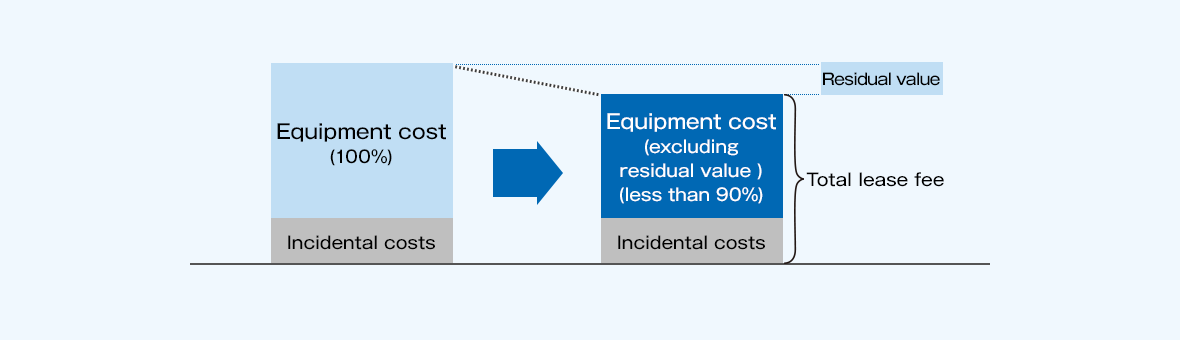

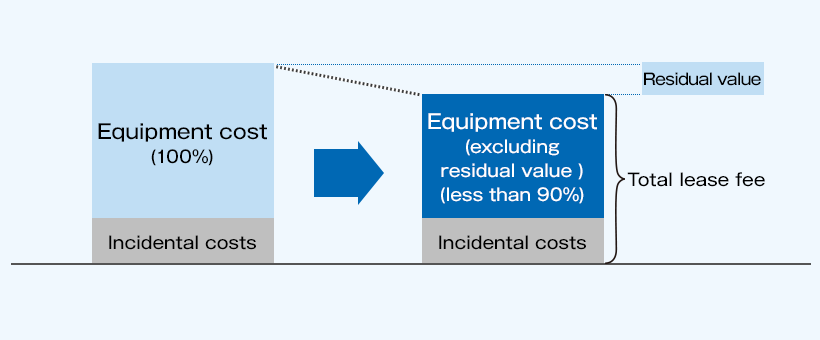

For properties with a forecasted secondhand value (generic properties that have a secondhand market), NTT TC Leasing calculates the predicted residual value (secondhand market price) at the start of the contract and subtracts this value from the price of the property when calculating the leasing fees.

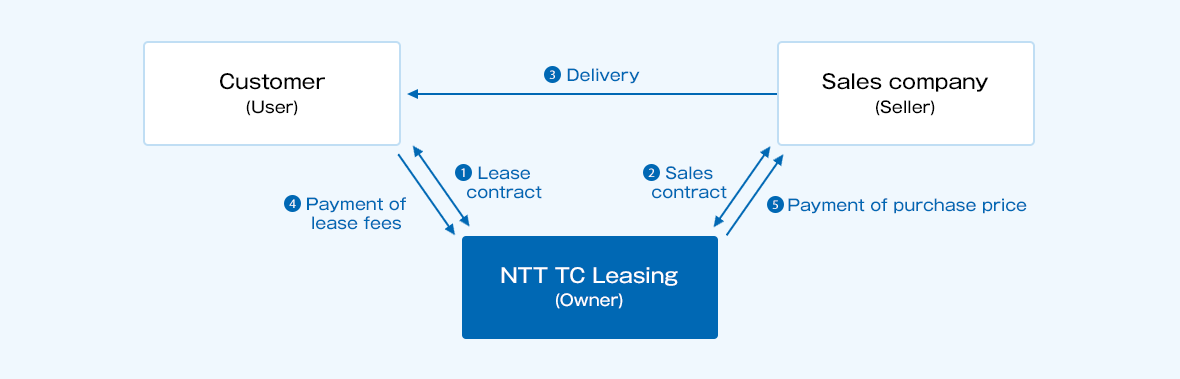

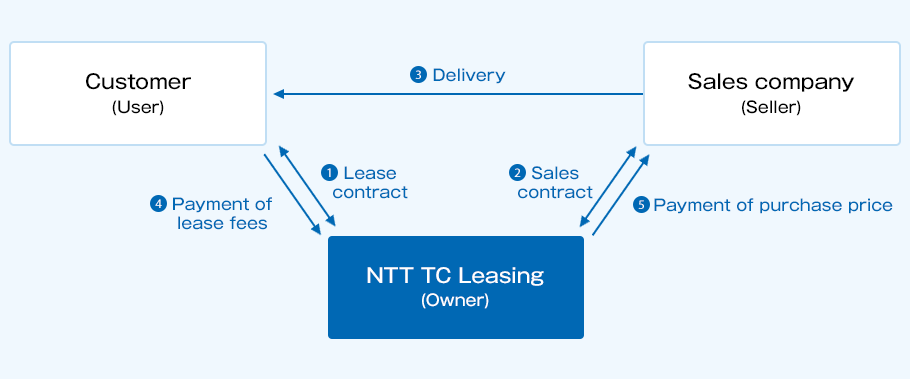

Business model

Difference from finance leases

- Since leasing fees are calculated based on the property price minus the residual value, customers can use a property for a relatively small leasing fee.

- Customers can set the lease term freely in accordance with manufacturing plans (plans for property usage).

- Customers can implement off-balance sheet financing, even under the new lease accounting standards.

- After a lease term ends, customers can choose to (1) re-lease, (2) purchase, or (3) return the property, depending on the state of the property.

Important notes

Customers are advised to check with their auditors in advance, as the customer will be responsible for making any decisions related to an operating lease.