Lease & Finance

About Leases

- Home

- Leasing & Finance

- NTT TC Leasing Services

- About Leases

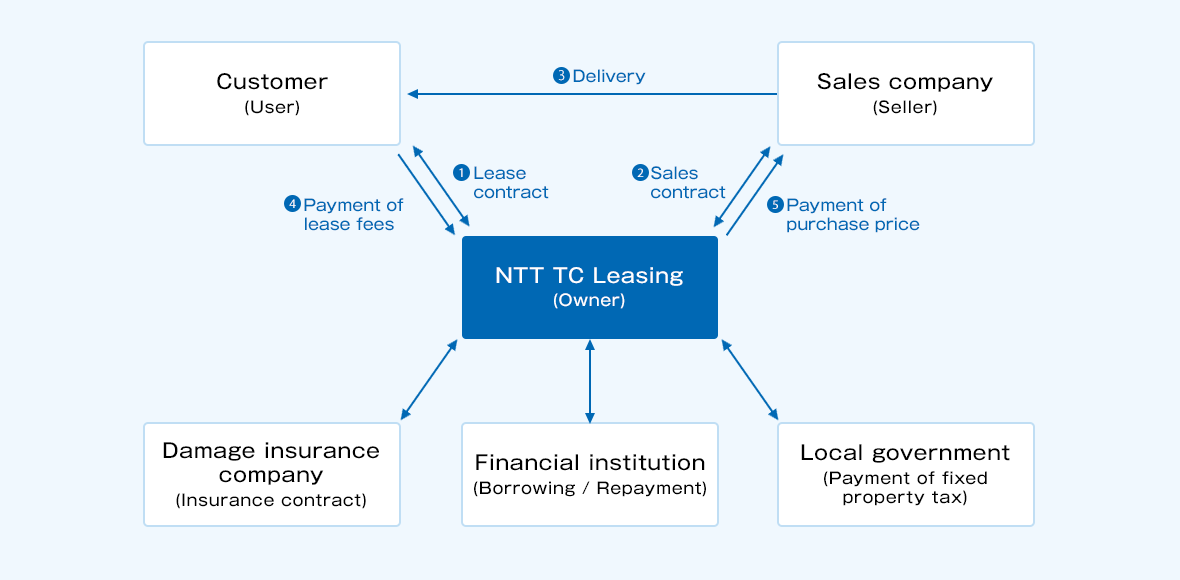

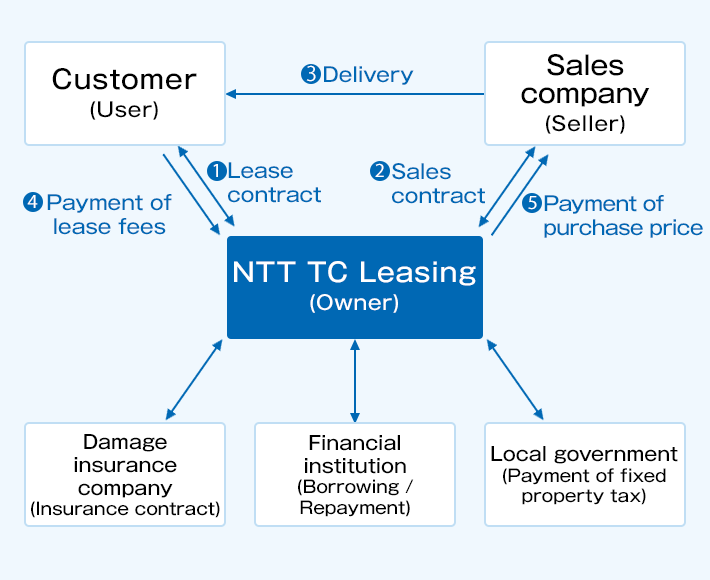

NTT TC Leasing's leases allow us to lend to customers equipment and devices purchased on their behalf.

For a fixed monthly leasing fee, customers can leave property related processes like depreciation and the payment of property tax and general insurance to us.

Benefits of leases

- 1. Use your funds efficiently

- For a small monthly leasing fee, customers can arrange for what they require. As customers won't need to make lump-sum payments, they will be free to use their remaining funds efficiently, on working capital for example.

- 2. Treat the fees as expenses

- Finance leases that don't involve the transfer of ownership can be accounted for as operating leases if the contract for a lease transaction is for three million yen or less, or if the lease is for a small or medium-sized enterprise.

- 3. Use the latest devices and equipment

- Lease terms can be set for a period shorter than the legal service life, tackling equipment becoming obsolescent. Leases are therefore an effective way to acquire access to cutting-edge devices and equipment.

In addition, leased properties can be swapped out for other items, even during the lease term. - 4. Streamline and cut office costs

- The ownership of leased properties belongs to NTT TC Leasing.

NTT TC Leasing will accordingly handle the troublesome paperwork associated with ownership, taking the burden off of our customers' shoulders.

Since 2007, a gap has emerged between the book value, as stipulated by the Corporation Tax Act, and the tax base amount for fixed assets, so such purchases will require management of both of these factors. - 5. Foresee predictable fees

- The monthly leasing fee is fixed, making it easy for customers to foresee costs and create business capital investment or financing plans.

Small and medium-sized enterprises may continue to account for the fees as operating leases should they wish to use small or short-term leases. - 6. Work outside of your bank's borrowing limit

- The use of a lease is similar to raising money over a long period of time. However, as a lease isn't a loan, you'll be able to leave your credit untouched.

- 7. Re-lease for a small fee

- After a lease term ends, customers can re-lease properties for a small fee (around one tenth of the annual fee for a one-year lease).

- 8. Cut down on disposal costs

- In accordance with the Waste Disposal Act, customers are responsible for properly disposing business-related waste and will be subjected to penalties should they dispose of waste inappropriately.

In the case of leased properties, customers will not need to concern themselves with disposal as NTT TC Leasing will do this on their behalf.

How leases work

The contract system at NTT TC Leasing allows us to purchase devices and equipment from manufacturers or distributors on behalf of our customers and then lend this equipment out to our customers over an extended period of time.

Service flow

An example of the leasing process (from considering a lease to the end of the lease)

- Business inquiry (referral)

- After discussing the desired property with a dealer (sales company), the customer reaches out to NTT TC Leasing.

![]()

- Preliminary leasing fee calculations

- The customer submits a company resume and financial statements (for the last three periods).

![]()

- Application

- We make a proposal after calculating leasing fees based on the estimate from the dealer (sales company).

![]()

- Screening

- NTT TC Leasing will review the submitted documents and contact the customer.

![]()

- Quotation

- NTT TC Leasing provides a quotation to the customer based on the conditions of the lease.

![]()

- Lease contract

- The customer reviews the contract details and signs or prints their name and affixes their seal on the contract.

![]()

- Order placement

- NTT TC Leasing enters into a purchase agreement with a dealer (sales company) and places an order for the property to be leased.

![]()

- Delivery of items

- The leased property is delivered directly from the dealer (sales company) to the location designated by the customer.

![]()

- Start of a lease (payment of leasing fees)

- After confirming receipt of the leased property, the customer provides an acceptance certificate and begins to pay the leasing fee.

![]()

- Payment for items

- NTT TC Leasing pays the dealer (sales company) directly for the property.

![]()

- End of a lease

- At the end of a lease term, customers are asked to choose between ending or extending (re-leasing) a lease. With re-leasing, customers can continue using the property for 1/10 of the annual leasing fee. If a lease is ended, the customer will return the leased property at their own expense to a location designated by NTT TC Leasing.