Leasing & Finance

Leasing & Finance

Loans

Overview

We provide corporate customers with working capital and capital investment funds.

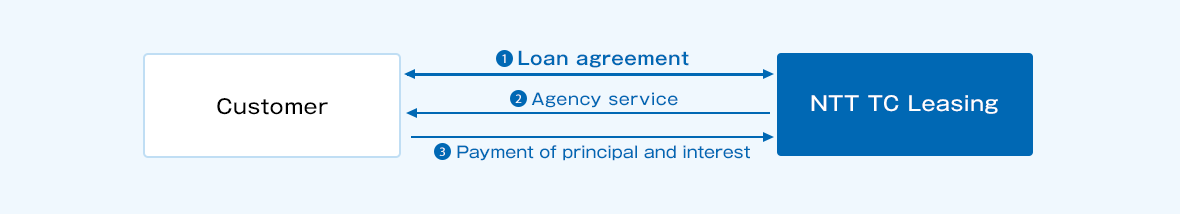

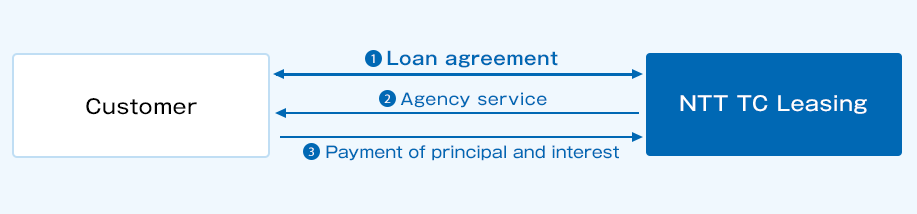

Business model

Loan conditions

For corporations (business loans)

| Interest rate | To be decided after consultations, with an annual interest rate of up to 15.00%. | ||

|---|---|---|---|

| Delay damages | The maximum annual interest rate is 20.00%. (Outstanding principal) x (Annual compensation rate) x {Number of days from the day after the previous payment date to the payment date ÷ 365 days} |

||

| Prepayment penalty | 1. For loans with fixed interest rates (Average balance) x (contracted interest rate - the market reinvestment interest rate according to the remaining period as of the prepayment date) x (actual number of days from the prepayment date to the repayment date) ÷ 365 days 2. For loans with variable interest rates If the prepayment date is not the contracted interest payment date: (Prepayment principal) x (contracted interest rate as of the prepayment date) x (actual number of days from the prepayment date to the next interest payment date) ÷ 365 days *However, the penalty amount shall not exceed the annual interest rate of 20.00%. |

||

| How interest is calculated |

|

||

| For matters involving collateral | We accept (revolving) mortgages, collateral securities, transfers of receivables, and other types of collateral required by our company for real estate purposes. | ||

| Repayment method Repayment period Number of repayments |

Repayment method | Repayment period | Number of repayments |

| A. Lump-sum repayment method | 1 month to 157 months | Once | |

| B. Even total payment method | 2 months to 420 months | 2 to 420 times | |

| C. Even principal payment method | 2 months to 420 months | 2 to 420 times | |

| D. Irregular payment method | Stipulated for each item in a contract. | ||

| Individual consultations will be conducted to set limits within the ranges shown above. | |||

| Repayment example |

|

||

[Designated organization for resolving disputes regarding our contracted loan businesses]

- Name: Japan Financial Services Association - Loan Business Consultation and Dispute Resolution Center

- Address: 3-19-15 Takanawa, Minato-ku, Tokyo 108-0074

- Phone number: 03-5739-3861

Benefits for customers

You can borrow funds from an agency besides a bank for a new way to raise finances.

Inquiries regarding loans

Department in charge: Each individual branch

Hours: 9:00 to 17:00

Monday to Friday (excluding holidays and year-end and New Year holidays)